Personal Loans copyright for Dummies

Personal Loans copyright for Dummies

Blog Article

The Main Principles Of Personal Loans copyright

Table of ContentsUnknown Facts About Personal Loans copyrightThe Of Personal Loans copyrightSome Known Details About Personal Loans copyright Get This Report about Personal Loans copyright6 Easy Facts About Personal Loans copyright Shown

This implies you've offered every buck a task to do. placing you back in the motorist's seat of your financeswhere you belong. Doing a routine budget will certainly give you the self-confidence you need to handle your cash successfully. Good things involve those that wait.Yet conserving up for the big points suggests you're not entering into financial debt for them. And you aren't paying extra over time due to all that rate of interest. Count on us, you'll enjoy that family members cruise ship or playground set for the children way more knowing it's currently paid for (as opposed to making repayments on them up until they're off to college).

Nothing beats peace of mind (without debt of training course)! You don't have to transform to personal lendings and debt when points get tight. You can be complimentary of financial obligation and start making genuine traction with your cash.

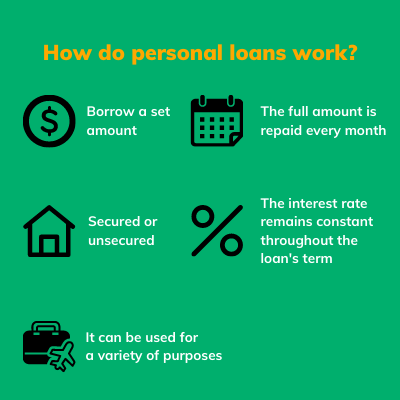

They can be secured (where you provide up security) or unprotected. At Spring Financial, you can be authorized to borrow cash as much as car loan quantities of $35,000. A personal funding is not a credit line, as in, it is not rotating funding (Personal Loans copyright). When you're accepted for an individual financing, your lending institution gives you the full quantity at one time and after that, generally, within a month, you begin repayment.

Unknown Facts About Personal Loans copyright

A common reason is to consolidate and combine debt and pay every one of them off at when with a personal lending. Some financial institutions placed stipulations on what you can use the funds for, but many do not (they'll still ask on the application). home renovation fundings and restoration loans, car loans for moving expenditures, trip car loans, wedding loans, clinical financings, vehicle repair work car loans, car loans for rent, tiny vehicle loan, funeral car loans, or other costs settlements in basic.

At Springtime, you can apply no matter! The demand for personal financings is climbing amongst Canadians interested in leaving the cycle of payday advance loan, combining their debt, and reconstructing their credit history. If you're looking for a personal funding, below are some things you ought to remember. Personal fundings have a set term, which suggests that you know when the financial obligation has actually to be repaid and how much your repayment is monthly.

Our Personal Loans copyright PDFs

Additionally, you may be able to lower just how much overall passion you pay, which suggests more money can be saved. Individual loans are powerful tools for building up your credit report. Settlement background make up 35% of your credit rating, so the longer you make routine settlements on time the much more you will see your rating increase.

Personal finances provide a wonderful possibility for you to rebuild your debt and settle financial debt, but if you do not budget correctly, you could dig on your own into an also much visit this page deeper hole. Missing one of your month-to-month payments can have an unfavorable result on your credit scores score however missing out on several can be devastating.

Be prepared to make every solitary payment on time. It's real that an individual loan can be utilized for anything and it's much easier to obtain accepted than it ever before was in the past. If you do not have an immediate need the added cash, it might not be the finest solution for you.

The taken care of regular monthly repayment quantity on a personal funding relies on exactly how much you're obtaining, the interest price, and the fixed term. Personal Loans copyright. Your rates of interest will certainly depend upon variables like your credit report and earnings. Most of the times, individual car loan rates are a great deal lower than bank card, however in some cases they can be higher

An Unbiased View of Personal Loans copyright

The market is fantastic for online-only lending institutions loan providers in copyright. Benefits include terrific rate of interest, exceptionally quick processing and financing times & the privacy you may want. Not everyone suches as strolling into a bank to request cash, so if his comment is here this is a hard area for you, or you just don't have time, considering on the internet lending institutions like Springtime is a great option.

That greatly relies on your capacity to pay back the amount & advantages and disadvantages exist for both. Payment lengths for individual loans generally drop within 9, 12, 24, 36, 48, or 60 months. Sometimes longer payment periods are a choice, though unusual. Much shorter payment times have very high monthly repayments yet then it mores than quickly and you don't shed more money to interest.

How Personal Loans copyright can Save You Time, Stress, and Money.

Your rate of interest can be connected to your settlement period as well. You could get a reduced interest price if you fund the car loan over a much shorter period. An individual term car loan includes a set settlement routine and a taken care of or floating rate of interest. With a drifting rate of interest rate, the rate of interest quantity you pay will certainly rise and fall month to month based upon market changes.

Report this page